Sukanya Samridhi Yojana 2024: Friends, the Prime Minister of our country Shri Narendra Modi has launched Sukanya Samriddhi Yojana (SSY Scheme) for the bright future of the country’s girls. If a little girl is born in your house and you are worried about her future, then you do not need to worry now. Because this Sukanya Yojana has been launched by the government only to meet the expenses of daughters and to meet the expenses incurred in marriage.

Under this scheme, a savings account is opened by parents before the completion of 10 years of age of their daughter. The guardian can open this account through a bank or post office. In this account, parents of the girl child can deposit from ₹ 250 to 1.5 lakh rupees per year. In the savings account opened under this scheme, the government is also given a compound interest on the amount deposited at a fixed rate.

Do Read:- LoanTap Se Loan Kaise Le 2024?

Sukanya samridhi yojana

If you want to open an account in Sukanya Samriddhi Yojana 2024 for your daughter’s future and want to take advantage of this scheme, then we will provide you complete information related to SSY scheme. For example, what is Sukanya Samriddhi Yojana, the characteristics of this scheme, its purpose, eligibility, necessary documents to open the account under this scheme, etc. are going to give detailed information.

Sukanya Samriddhi Yojana 2024 (SSY Scheme)

Sukanya Samriddhi Yojana has been launched by the central government to meet the expenses of daughters in future, higher education and marriage in future so that the parents can get rid of their daughters and take care of them well. This is an ambitious scheme launched under Bachao Beti Padhao, daughter of the Government of India.

Under the Sukanya scheme, the investment account of his girl is opened by the parents. In which minimum can be invested from minimum ₹ 250 to maximum Rs 1.5 lakh per year. At present, interest is being provided at the rate of 7.6% on the amount deposited in Sukanya account. If you need more information related to SSY scheme, then you read this article further.

The purpose of Sukanya Samriddhi Yojana 2024

The main objective of the government launching Sukanya Samriddhi Yojana is to secure the future of girls. Often, the parents of the poor family are worried about what their daughter’s future will be like, they are always concerned about the students’ education and marriage expenses. Sukanya Yojana has been launched by the government to free all these concerns.

Through this scheme, parents belonging to any poor family can easily open a savings account for their daughter’s bright future and invest in it. Due to this, if the daughters grow up, they will not have to worry about money and daughters will also be able to become self -sufficient.

Do Read:- Rojgar Sangam Yojana Scheme Details

Sukanya Samriddhi Yojana 2024 (SSY Scheme)

Sukanya Samriddhi Yojana has been launched by the central government to meet the expenses of daughters in future, higher education and marriage in future so that the parents can get rid of their daughters and take care of them well. This is an ambitious scheme launched under Bachao Beti Padhao, daughter of the Government of India.

Characteristics of Sukanya Samriddhi Yojana (SSY)

- The SSY scheme has been launched by Prime Minister Narendra Modi for the girls of the country.

- Under this scheme, parents can open a savings account for their daughter’s bright future.

- The girl child’s parents can operate the savings account opened under this scheme till the age of 10 years.

- You can deposit minimum ₹ 250 to maximum of 1.5 lakh rupees per year in the account opened by the girl’s parents.

- Under the Sukanya scheme, it is mandatory for the account holder to invest for 15 years in an account opened.

- If parents want to withdraw deposits in this account for their daughter’s higher education, then after completing the age of 18 years, 50% of the deposits can be withdrawn.

- If no amount is deposited after opening an account in the name of the girl child, then a penalty of ₹ 50 is imposed on the account.

- Investors are provided interest at the rate of 7.6% under the given SSY scheme.

- On opening an account under this scheme, you are also given tax exemption as per the Income Tax Act.

- Under the Sukanya scheme, an account of two girls can be opened from a family.

Eligibility for Sukanya Samriddhi Yojana

- Under this scheme, the girl and their parents should be permanent residents of the country to open an account.

- In Sukanya scheme, only two girls of a family can be opened account.

- The age of the girl should be less than 10 years to open an account under Sukanya Samridhi Yojana.

- Under this scheme, only one account can be opened on the name of a girl child.

Documents required for Sukanya Samriddhi Yojana

SSY Scheme Required Documents: If you want to open your daughter’s account under Sukanya Samriddhi Yojana, then you will need the following documents that you will have to take a bank or post office. All documents are as follows –

- The girl should have a birth certificate.

- Parent’s Aadhaar Card / PAN Card / ID Card

- Address proof

- Documents sought by the bank and post office.

- Passport Size Photo

Do Read: IDBI Royal Signature Credit Card Benefits

List of banks to open SSY account

The list of banks for opening an account is given below under Sukanya Samriddhi Yojana. By going to the nearest branch of all these banks, you can open a savings account for the future of your daughter.

- state Bank of India

- Punjab National Bank

- Bank of india

- Bank of Baroda

- Bank of Maharashtra

- Allahabad Bank

- axis Bank

- Andhra bank

- Punjab & Sindh Bank

- Union Bank of India

- Uco bank

- Vijay Bank

- Oriental Bank of Commerce

- State Bank of Hyderabad

- Bank of Maharashtra

- United Bank of India

- Canara Bank

- Dena bank

- State Bank of Patiala

- State Bank of Mysore

- IDBI Bank

- State Bank of Travancore

- ICICI Bank

- State Bank of Bikaner and Jaipur

When can you withdraw deposits in SSY account

- If you deposit money in the account under the Sukanya scheme and you want to withdraw the amount deposited, then you can withdraw the amount deposited in the following condition.

- If the age of the girl is completed 18 years, then she can withdraw 50% of the amount deposited in the account for higher education.

- But funds can be withdrawn once in 1 year and in the installment for a maximum of 5 years.

- It is mandatory to invest in investment account opened under Sukanya scheme for 15 years.

- Under which circumstances can SSY account be closed

- In these circumstances, you can close Sukanya account before completing the age of 18 years and withdraws deposits in the account.

- In the event of a girl’s marriage: The beneficiary can withdraw money before the maturity period for her marriage expenses after the girl is completed by the girl.

- In case of the death of the account holder: If the account holder dies accidentally, then in this situation the girl’s parents can withdraw the deposit in Sukanya Yojana account.

- To be financially unable to continue the account: If the beneficiaries are unable to continue the girl’s account by the guardian, the SSY account can be closed before the maturity period in this situation.

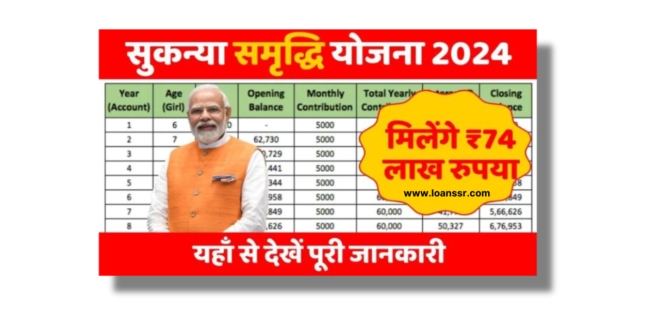

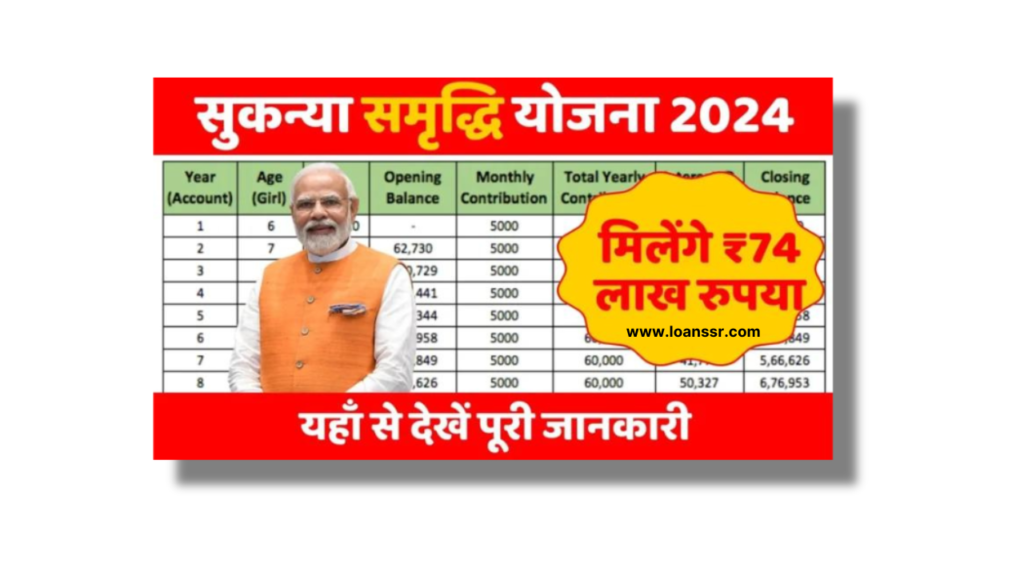

Sukanya Samriddhi Yojana Calculator 2024

If you want to calculate the maturity amount then you can calculate through Sukanya Samriddhi Calculator. Maturity amount can be obtained through details like investment and interest rates made every year. A 7.6% interest rate is provided on the amount deposited under SSY Scheme.

How much will you get after depositing ₹ 1000 under Sukanya Samriddhi Yojana?

- Total amount of Rs 12,000/- in 1 year for depositing 1000 per month

- The total amount deposited in 15 years is Rs 1,80,000/-

- Total interest on the amount deposited for 21 years is Rs 3,29,000/-

- Total amount received on maturity is Rs 5,09,212/-

How much will you get after depositing ₹ 2000 in Sukanya scheme

- Total amount of Rs 24,000/- in 1 year for depositing 2000 per month

- The total amount deposited in 15 years is Rs 3,60,000/-

- Total interest on the amount deposited for 21 years is Rs 6,58,425/-

- Total amount received on maturity Rs 10,18,425/

How much will be available for depositing ₹ 5000 in Sukanya scheme

- Total amount of Rs 60,000/- in 1 year for depositing 5000 per month

- The total amount deposited in 15 years is Rs 9,00,000/-

- Total interest on the amount deposited for 21 years is Rs 16,46,062/-

- Total amount received on maturity is Rs 25,46,062/-

How much will you get after depositing ₹ 10000 in Sukanya scheme

- Total amount of Rs 1,20,000/- in 1 year for depositing 10000 per month

- The total amount deposited in 15 years is Rs 18,00,000/-

- Total interest on the amount deposited for 21 years is Rs 33,30,307/-

- Total amount received on maturity Rs 51,03,707/-

How much will you get after depositing ₹ 12000 in Sukanya scheme

- Total amount of Rs 1,44,000/- in 1 year for depositing 12000 per month

- The total amount deposited in 15 years is Rs 21,60,000/-

- Total interest on the amount deposited for 21 years is Rs 39,50,549/-

- The total amount received on maturity is Rs 61,10,549/-

How to open accounts under Sukanya Samriddhi Yojana 2024

- To open a SSY account, the first guardian has to go to his nearest bank or post office.

- Now from here they have to collect the application form for Sukanya Samriddhi Yojana.

- Now you have to fill all this information asked in this application form very very carefully.

- After filling the form, attach all the necessary documents sought in it with the form.

- After completing such a process, you have to go to the bank or post office and submit the application form.

- In this way, you can open your daughter’s account under Sukanya Samriddhi Yojana.

Do Read:- My Shubh Life Personal Loan App se Loan Kaise le?

FAQs (Sukanya Samridhi Yojana)

Question 1. How to open an account under Sukanya Samridhi Yojana?

Answer. If you want to open an account for your girl’s bright future under Sukanya Yojana, then you can open an account by going to your nearest bank or post office.

Question 2. Can I close my Sukanya Samriddhi account?

Answer. Some conditions have been implemented for the closure of Sukanya Yojana account, which we have given you detailed information in this article.

Question 3. What documents are required to open Sukanya account?

Answer. Sukanya Samriddhi Yojana application form, girl’s birth certificate, Parent’s Aadhaar Card, PAN Card, ID, Passport Size Photo and other documents sought by the bank or post office are required to open an account under Sukanya Yojana.

Question 4. What is the helpline number for Sukanya Samriddhi Yojana?

Answer. If you want any information related to this scheme, then you can get information by contacting its helpline number (toll free number) 18002666868.

Loan SSR India's No.1 Finance Blog

Loan SSR India's No.1 Finance Blog